Free Assignment of Promissory Note Templates in Various Formats

The promissory note is one of the financial instruments containing a paying agreement of a definite amount of money in the written form of two parties, in which one is owing to the other. The paying agreement can be made on a specific date in the future or by the lender’s demand. Inside the document are the details about the debt, such as the principal amount, interest rate, date issued, and the parties’ signatures. Meanwhile, the assignment of the promissory note contains the recorded assignment in which the lender sells the debt to another debt institution such as a bank.

Assignment of Promissory Note Purpose

Promissory notes have weaker legal power than a mortgage contract. It is typically used by the people who don’t qualify to buy the property with the help of a loan from a mortgage. However, in the process of an assignment of a promissory note, the document still needs to be signed over to the new loan’s owner as of the financing process.

- Reminder Note Template

- Baby Shower Thank You Note

- Progress Note

- Thank You Note after Phone Interview

- Doctor Note for School Template

Assignment of Promissory Note Basic Components

The elements of promissory note might be different in each region regarding the local law. However, some components must be made clear in the document of a promissory note. Here are several pieces of information to include inside the document:

- The identity of payer/renter: input the name of the person who’s making the debt, and obligated to repay the loan.

- The identity of payee/lender: input the name of the person or entity who owns and lends the money.

- The date: write down the effective period of date for repayment.

- The principal amount: write down the amount of money loaned by the payer.

- The interest rate: write down how much the payer is charged by interest rate.

- The payment date: determine on what date the payer is obligated to make the payment each month.

- The end date of the promissory note: determine the date of the last payment of the debt.

Assignment of Promissory Note Categories

Before the process of assignment of promissory note takes place, you should identify the note’s type, which will be explained below. The type depends on the loan type and the information that the document carries inside.

- Personal/informal note: is used on a loan process between trustworthy family members or friends.

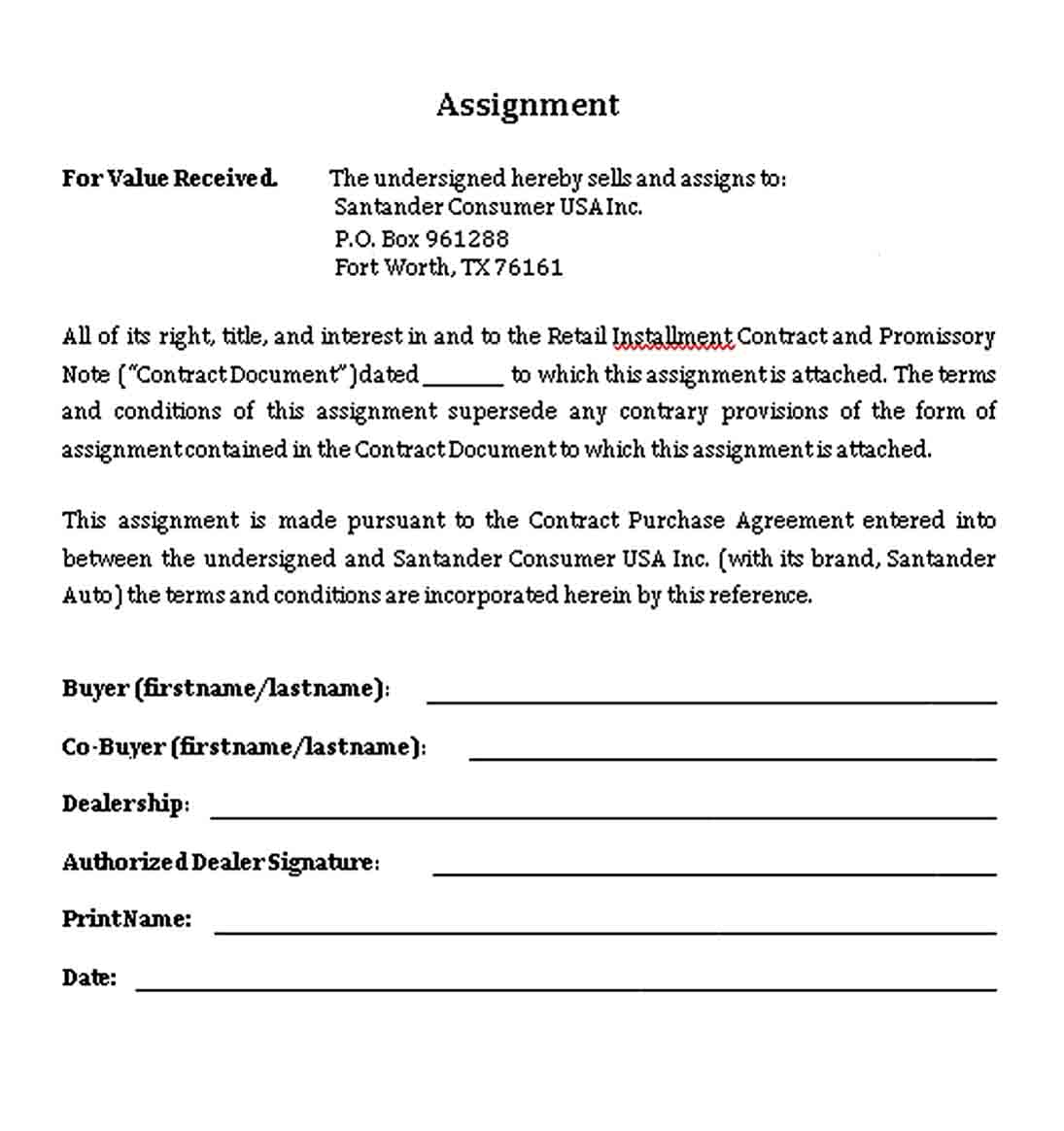

- Commercial note: is made in a more rigid or formal nature, and contains detailed loan conditions.

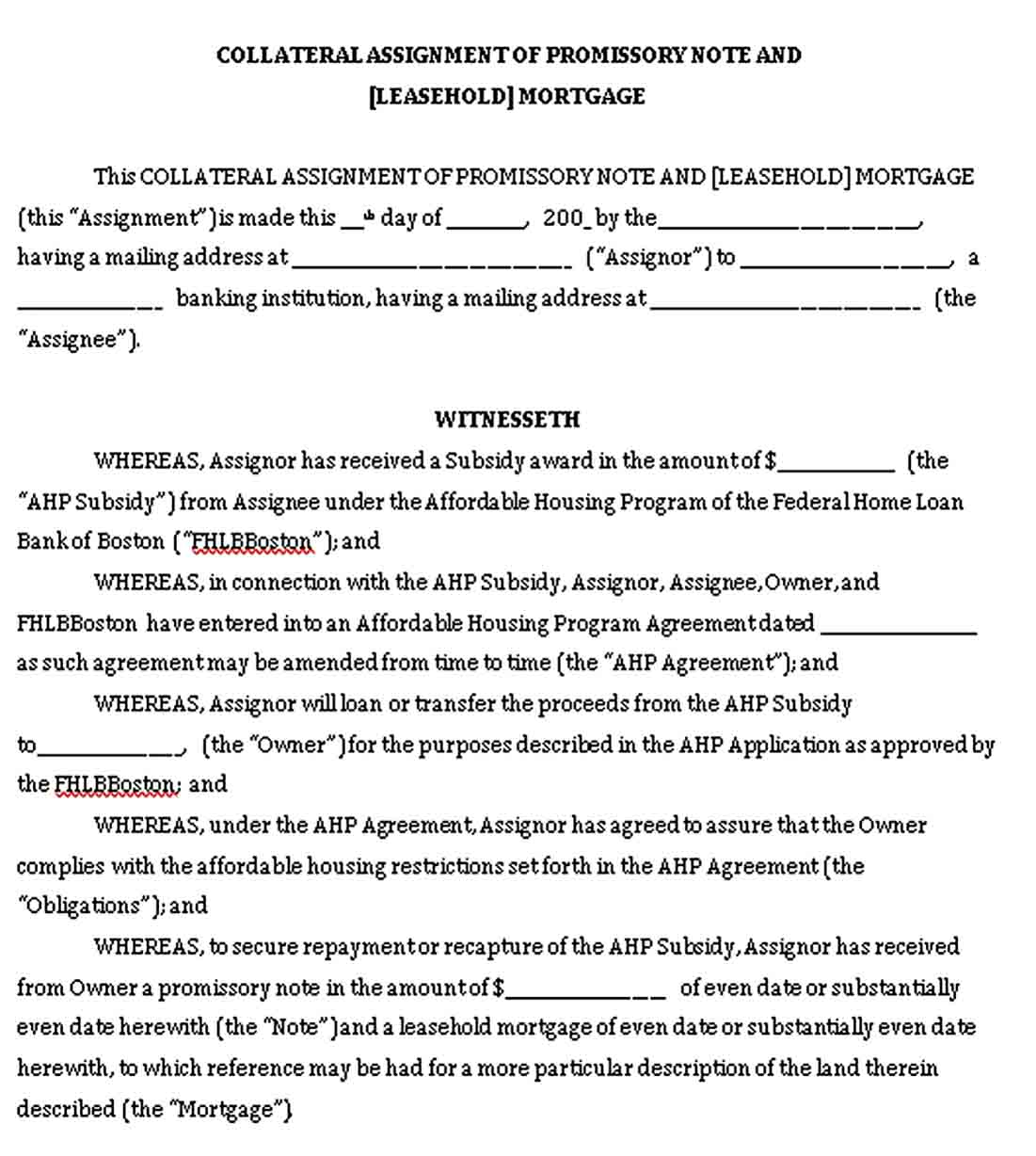

- Real estate note: is used to accompany the home or property purchase.

- Investment note: is used by a company to sell their shares to the investors.

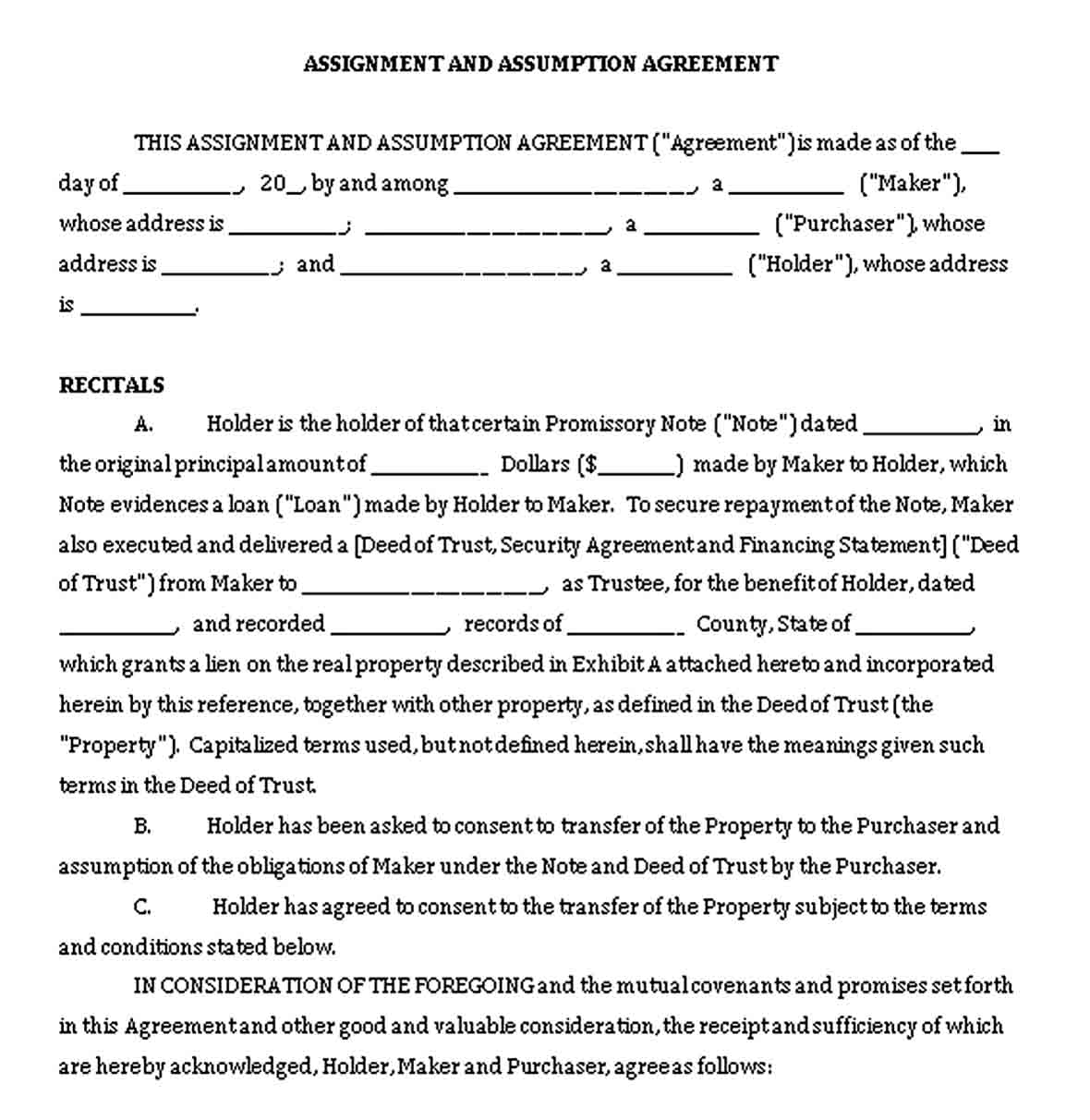

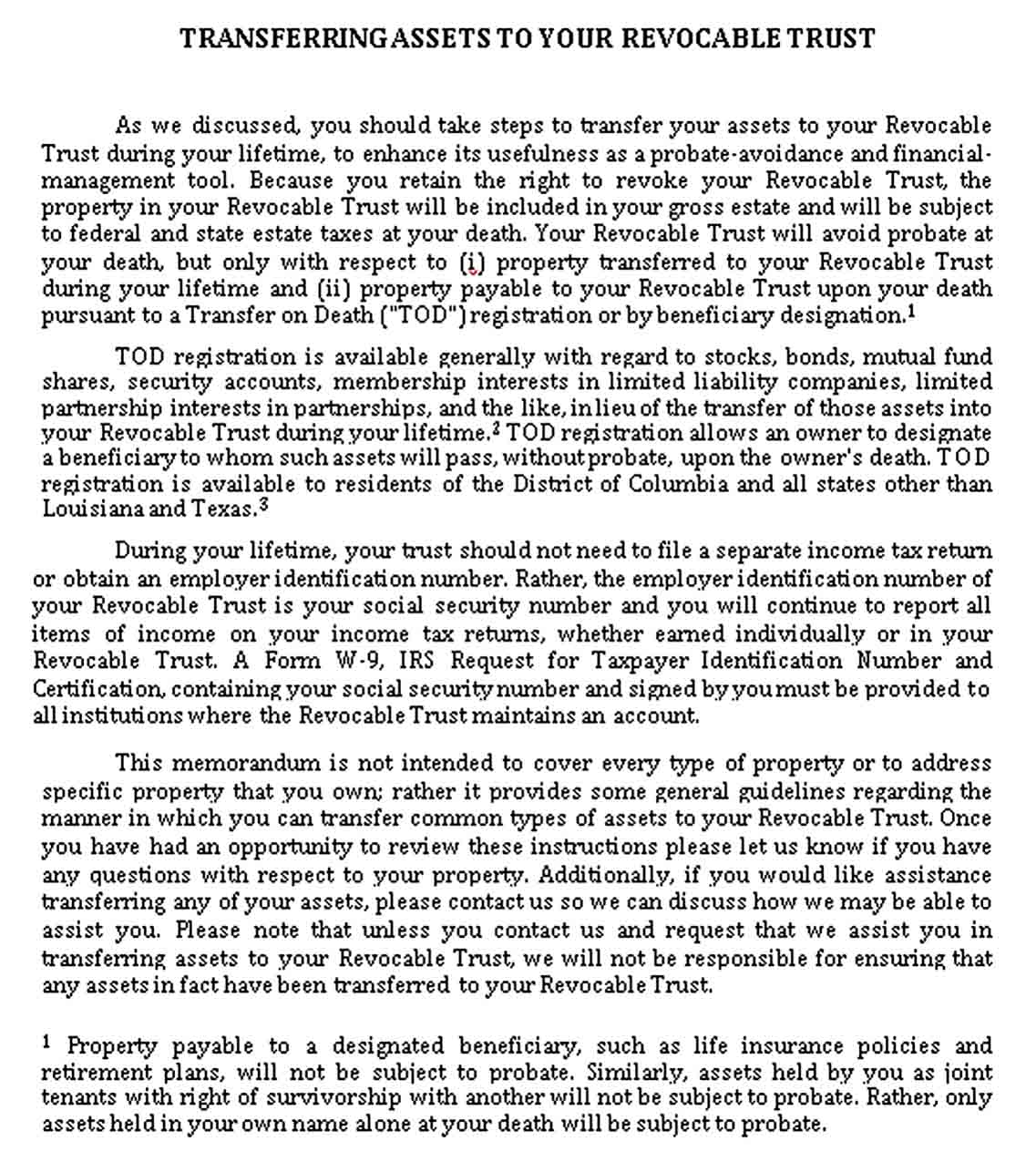

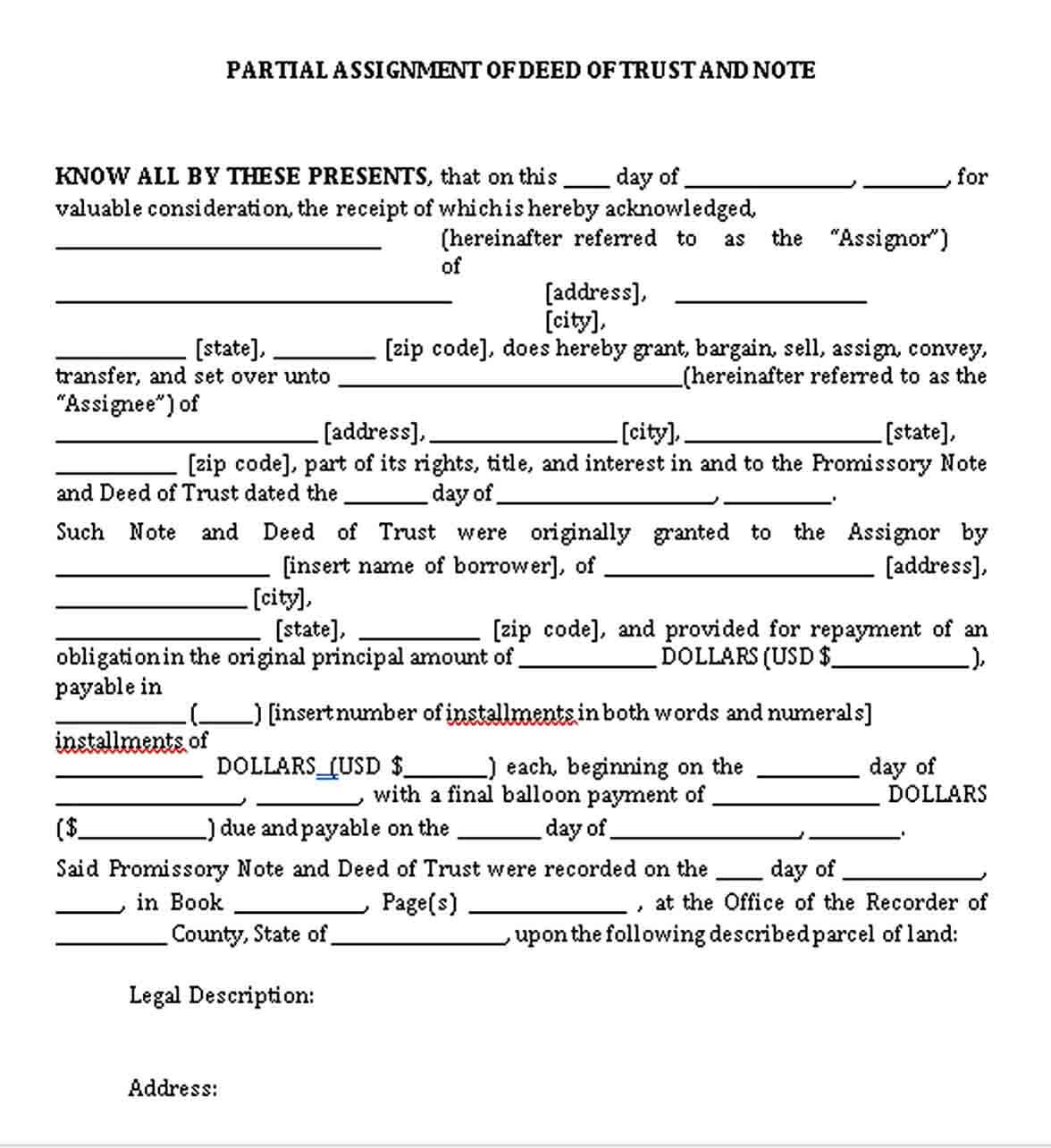

Assignment of Promissory Note Templates

One thing you have to keep in mind before using the template is that the notes are legally binding documents so both parties must be made aware before it is signed, of the consequences in case the terms are not followed correctly. There are various categories of assignment of promissory note you can find on this page, to use for free. They are easy to download, use, and edit according to your needs to match the requirement of the loan agreement.

Similar Posts:

- Student Loan Promissory Note

- Master Promissory Note

- Blank Promissory Note Templates

- Secured Promissory Note

- Loan Promissory Note

- Small Business Promissory Note

- Mortgage Promissory Note

- Promissory Note Form

- Promissory Note Template

- Negotiable Promissory Note

- International Promissory Note

- Note Template for Personal Loan

- Debit Note Templates

- Credit Note Templates

- Application Note Template

- Sales Note Template

- Transfer Note Templates

- Thank You Note Sample