Why is Mortgage Promissory Note Important?

In the United States, buying a house is quite expensive. Naturally, you do not always have enough money to buy it. However, it is not impossible if you get a loan to buy the dream house as soon as possible. If you apply for this loan, you will usually be asked to sign a mortgage note. However, if you have applied for a loan from the same agency or organization before, you will be asked to sign the master promissory note. The lender’s goal is to ask the borrower to sign mortgage promissory note solely to protect them if the borrower refuses to pay the debts.

What is Mortgage Promissory Note?

The mortgage promissory note is a combination of two separate things: mortgage and promissory notes. However, the two are often combined into one sentence. It is because these two things are the most important stuffs when you take out a loan to buy the house or other property.

- Note Template for Personal Loan

- Wedding Thank You Note

- Student Loan Promissory Note

- Medical Doctor Note

- Progress Note

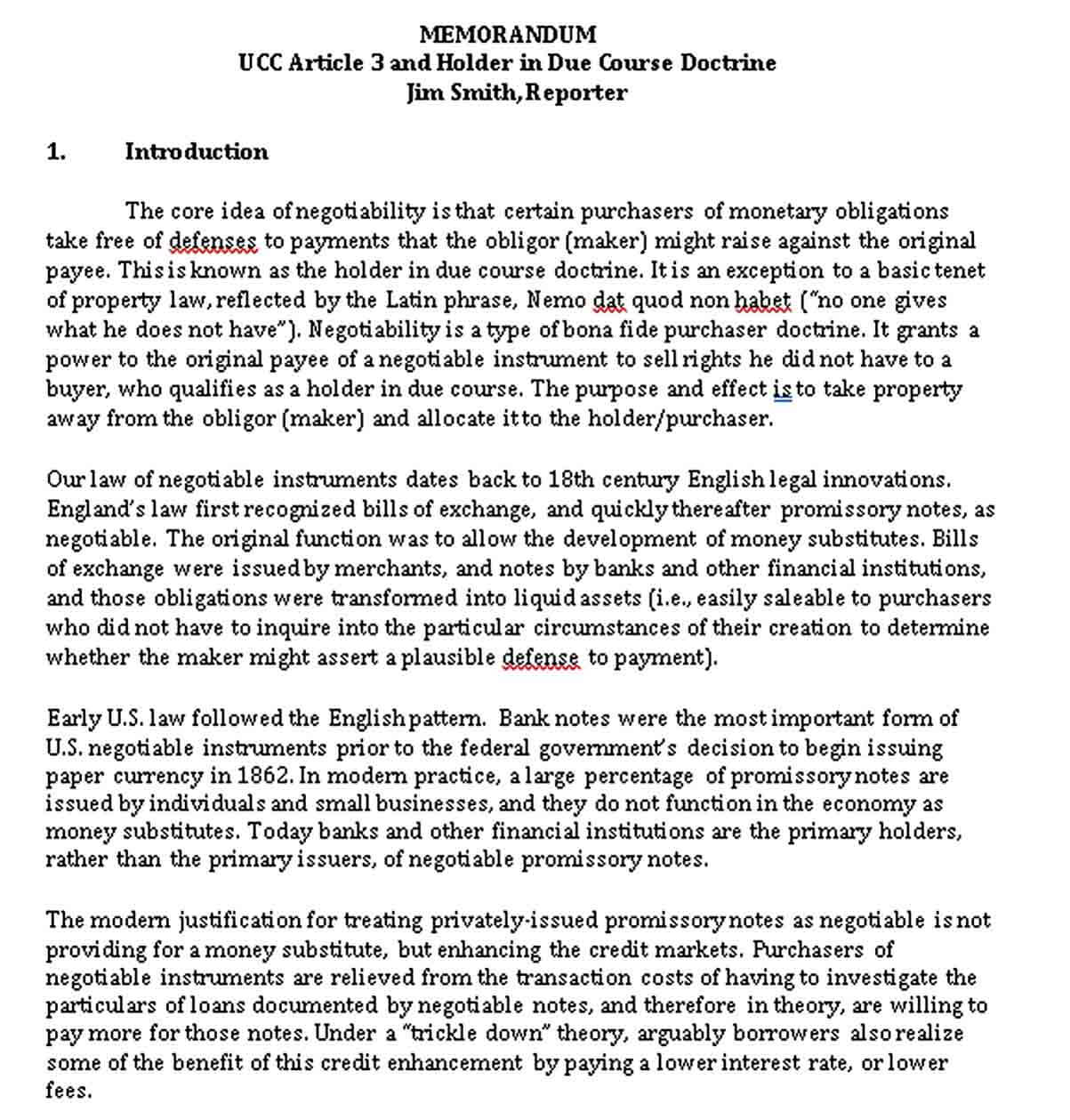

Promissory notes are more like IOU from lenders to borrowers. This is a legal document that you must sign as a borrower stating if you understand your obligation to pay to the lender within a specified time interval. It has become a common standard of real estate contracts.

If the promissory notes are IOU, then the mortgage is a document that explains what happens if you do not pay the debt according to the IOU (the most common thing that happens is a confiscation of property).

The Benefit of Mortgage Promissory Note

Both mortgages and promissory notes have their benefits. The purpose of mortgage or also known as a deed of trust is to provide a sense of security to the lender. By using mortgage as proof of agreement, the lender can sell your house if you cannot pay the debt. Meanwhile, the promissory note makes you, as a borrower; know the detail of your obligations. It is intended when something happens that harms you, you can prove it with this note.

Different Type of Mortgage Promissory Note Template

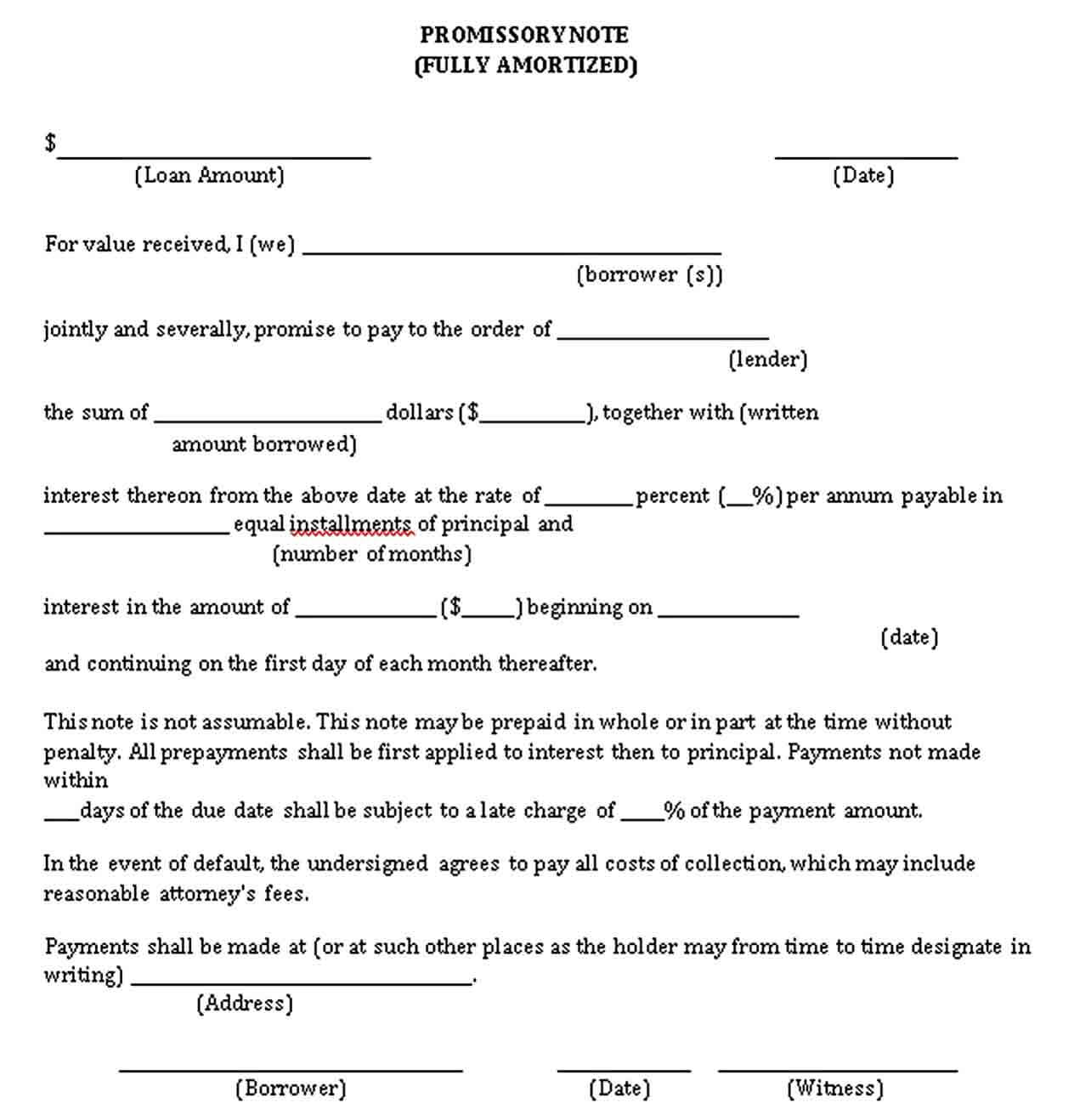

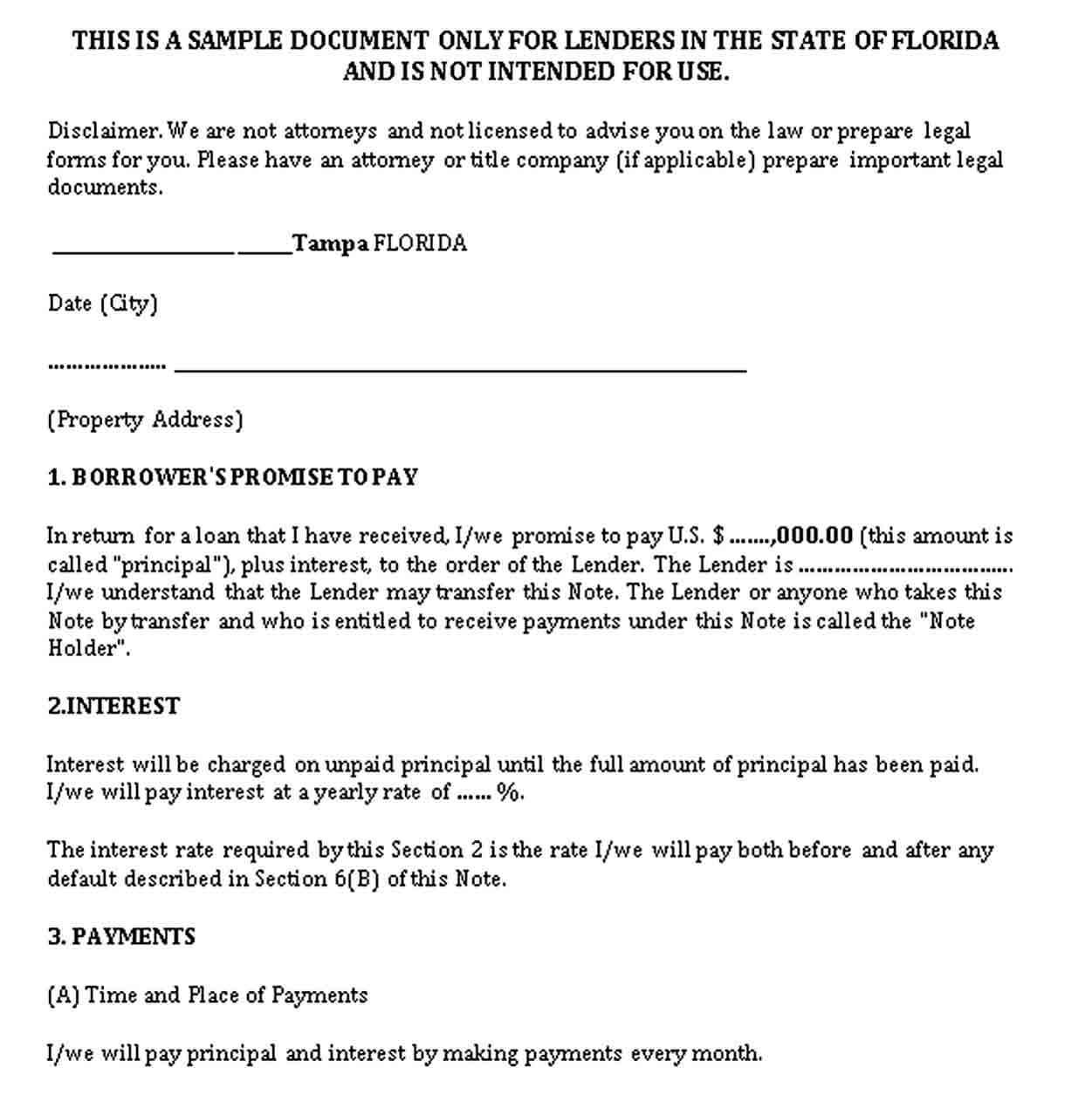

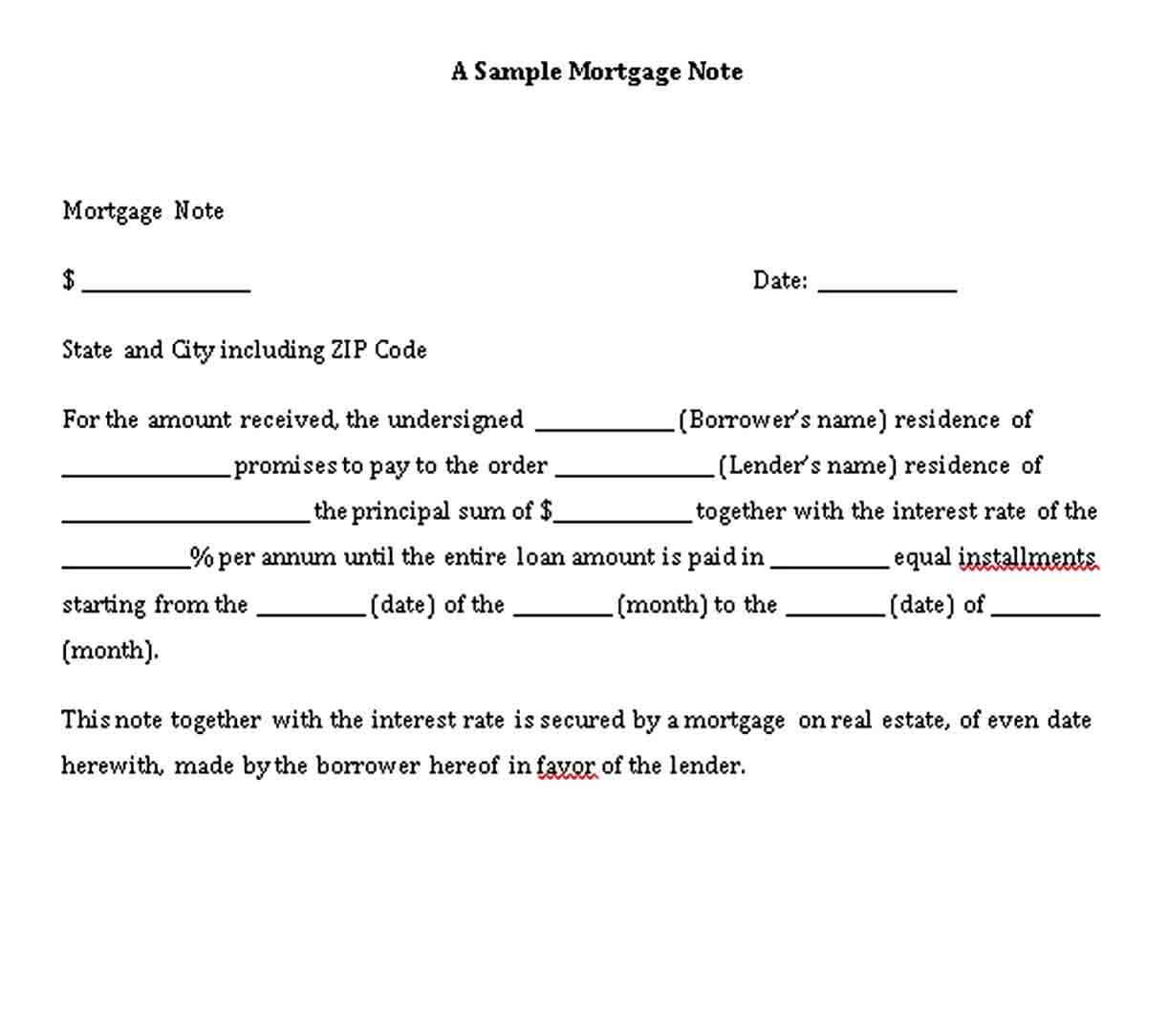

Besides providing information about mortgage promissory note, you will also find various types of templates in this page. It can be used in making the note. For your information, each template has its function. The available templates are as follows.

- Mortgage Promissory Note Sample

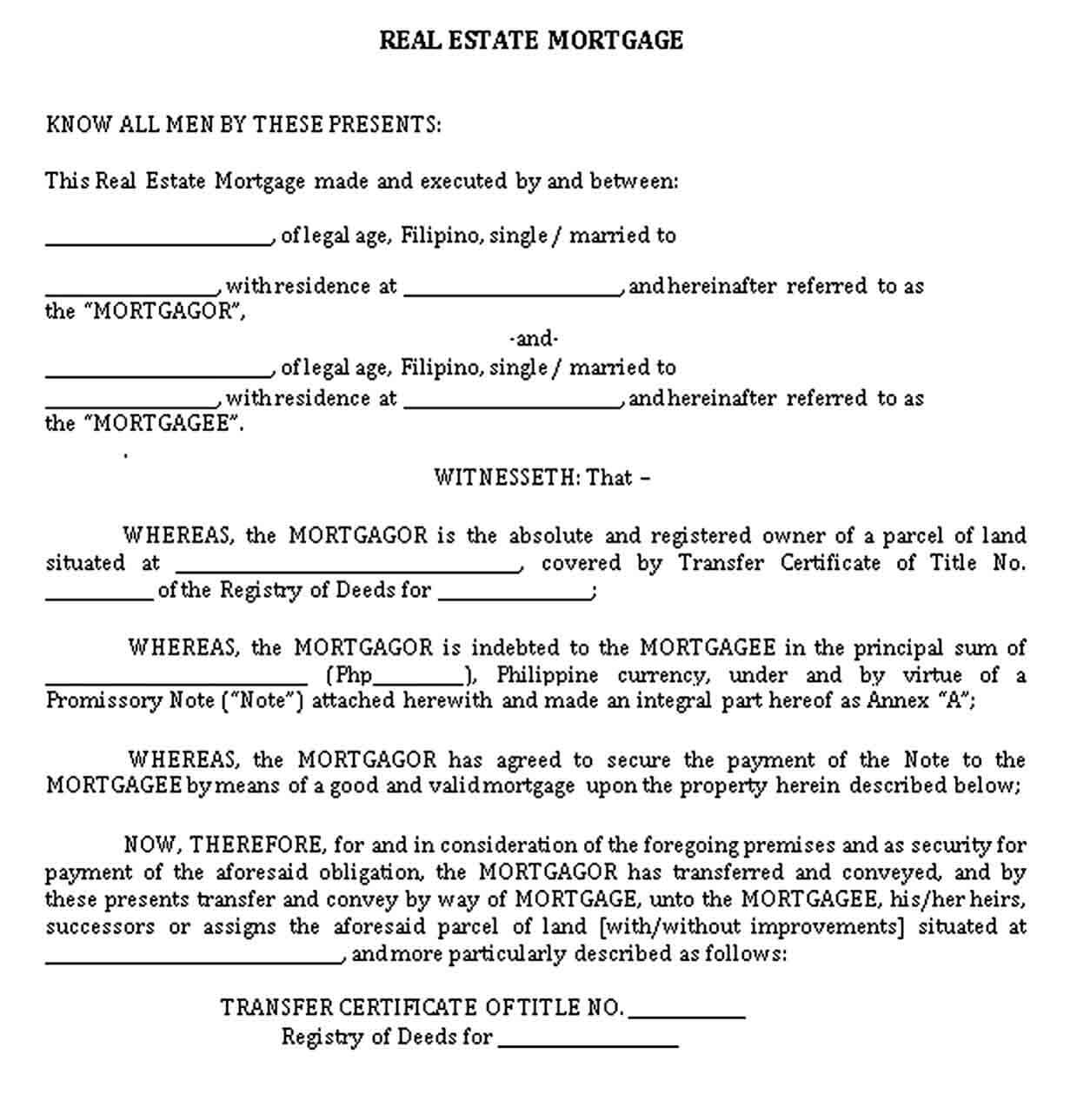

- Real Estate Mortgage

- Mortgage Promissory Note Form

- Promissory Note and Mortgage Instrument

- Fully Amortizing Note

What to Write on Mortgage Promissory Note

There is no specific format for writing the mortgages and promissory note. However, promissory notes state clearly and in detail that the borrower promises to repay the debt, including repayment terms. As for writing a mortgage, you will usually also be asked to take responsibility for taking care of the property, such as paying taxes, insurance for the property, etc.

If you need mortgage promissory note template, you can find it for free. On the website, you will find various types of templates in several formats. Besides, there are also various kinds of writing information and other templates for your project.

Similar Posts:

- Student Loan Promissory Note

- Secured Promissory Note

- Assignment of Promissory Note

- Master Promissory Note

- Loan Promissory Note

- Small Business Promissory Note

- Blank Promissory Note Templates

- Negotiable Promissory Note

- Promissory Note Form

- International Promissory Note

- Musical Note

- Promissory Note Template

- Doctor Note for School Template

- Thank You Note after Interview

- Note Template for Personal Loan

- Concept Note Template

- School Cornell Note

- Lesson Note